If you have sought care for your mental health in the form of therapy or via a psychiatrist, you have probably navigated the murky waters of insurance coverage. For the most part, insurance coverage in the United States is tied to your job, meaning that your employer offers you a plan with a few options.

Other avenues of insurance include state-funded insurance for individuals with a limited income and purchasing insurance on the open marketplace (this usually occurs if you are self-employed or unemployed and do not qualify for state insurance). Regardless of your insurance, navigating insurance lingo when seeking mental health treatment is tricky. However, being covered by an insurance plan can help you get access to higher-quality recovery treatment. It is important to understand the lingo to maximize your coverage benefits.

Do I wait until I meet my deductible to seek treatment for my mental health?

One of the most common fallacies is that many people assume they should wait until the end of the year to schedule costly medical and mental health visits because they would have met their deductible by that time. However, this is not always the case. What if you haven’t met your deductible and are waiting as your symptoms worsen? What if your provider is booked up, as they most likely are at the end of the year? What if you have already met your deductible but still have not met your out-of-pocket maximum? What if you have met your deductible but only have one more month in the calendar year until your deductible renews and are now paying fully out of pocket in January?

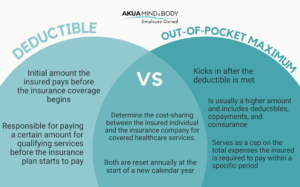

Defining deductible vs. out-of-pocket maximum

To truly understand why you should seek mental health treatment, whether you have met your deductible or not, it is first helpful to be clear on this complicated terminology. In many cases, insurance policies align with the calendar year, and deductibles renew at the start of every year. The cost of mental health treatment and services may come as a shock to you, and there is an unfortunate lack of knowledge when it comes to health insurance and its benefits. As a result, many individuals seeking mental health treatment will not pursue treatment because they are discouraged by their deductible, as insurance will not pay for the services until the deductible is met. Many individuals pay for monthly insurance coverage without reaping the benefits of having medical insurance and seeking proper treatment and care. The result: their symptoms worsen.

A deductible is the amount of money you pay for covered healthcare services before your insurance plan starts to pay. So, for example, if your deductible is $1,500, you are responsible for paying the first $1,500 of qualifying services yourself. Deductibles can range widely depending on your plan, and in general, the lower your monthly premium, the higher your deductible. Once you have reached your deductible, you will split your medical and mental health care costs with your insurance company until you have reached your out-of-pocket maximum.

The out-of-pocket maximum kicks in after you have reached your deductible and is usually a higher amount, such as $5,000. In general, your insurance company will pay a percentage of your medical bills (on average 70-80%, also referred to as co-insurance) once you have reached your deductible until you have reached your out-of-pocket maximum. Once you have reached your out-of-pocket maximum for the year, your insurance coverage will pay 100% of your medical costs for the rest of the year. Once the calendar year resets, this cycle starts over. Your out-of-pocket maximum helps protect you if you need expensive medical care such as surgery or chemotherapy. You will still need to pay the monthly cost of your insurance plan, even after you have reached the out-of-pocket maximum.

It is important to note that preventive services such as screenings and vaccines are now free and do not play into your deductible or out-of-pocket maximums.

When should I seek treatment?

If you seek mental health treatment at the beginning of the year, you most likely will have to pay until you meet your deductible; however, you may meet this relatively fast as mental health treatment can be costly. Once you meet your deductible, you have the rest of the year to benefit from your health insurance, covering part of your costs until you meet your out-of-pocket maximum, then ample time after that for cost-free treatment until the end of the year.

Alternatively, if you wait until after you meet your deductible to seek mental health treatment, you may only have a limited time left in the year to have your insurance plan cover you as the deductible and out-of-pocket maximum renew at the beginning of the year.

At the end of the day, you will either meet your deductible, or you will not meet your deductible, but you must seek medical treatment in order to have the possibility of meeting your deductible. You are paying a monthly premium to have insurance coverage, so it is best to take advantage of this and not neglect your mental health treatment. Call: (888) 629-6707